Close more loans, faster

To survive and succeed in today’s mortgage market, you need a streamlined and optimized sales process. Velocify®, a part of the ICE Mortgage Technology® Platform, puts sales automation to work to keep your team organized and focused on activities that drive more business.

GET STARTEDThe lead management software that delivers a $25 return for every $1 spent

Discover the industry’s leading sales automation solution that enables loan officers to more efficiently and effectively drive sales, communicate with borrowers, and close loans faster. Explore the Velocify solutions below, and choose the one that works best for your business.

Velocify Pulse®

Streamline and enforce your unique sales process within Salesforce so your sales leaders, Salesforce admins, and loan officers can focus on growing the business and closing more loans. Your Salesforce environment will instantly become a powerful sales prospecting, closing, and reporting engine.

Learn more

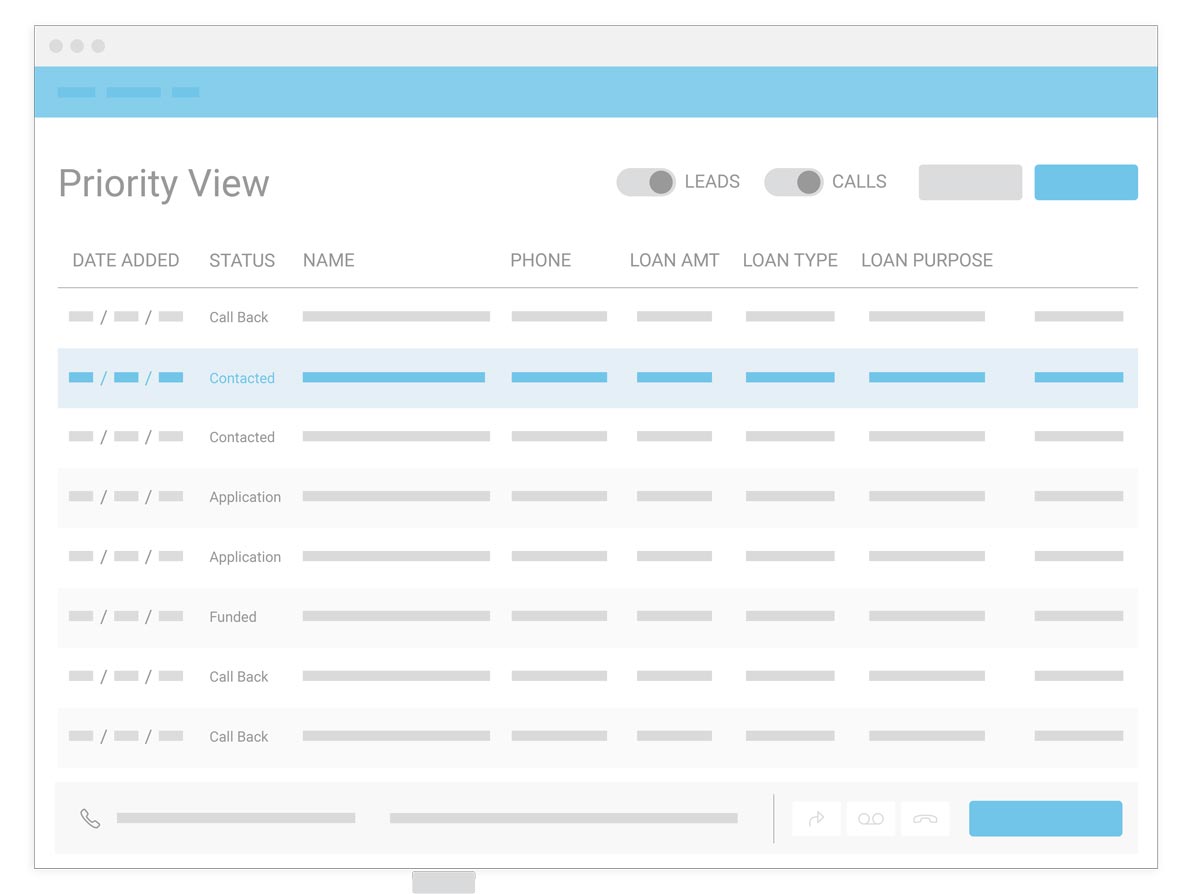

Velocify LeadManager Enterprise™

Are you ready to increase your lead conversion rates by up to 400%? Retrieve mortgage leads from over 1,400 integrated lead sources, automatically distribute new leads and reassign unworked leads, prioritize all sales communications, and create customized sales workflows so all leads are acted upon. Respond faster to high-priority leads, sell smarter, and close more loans.

Learn more

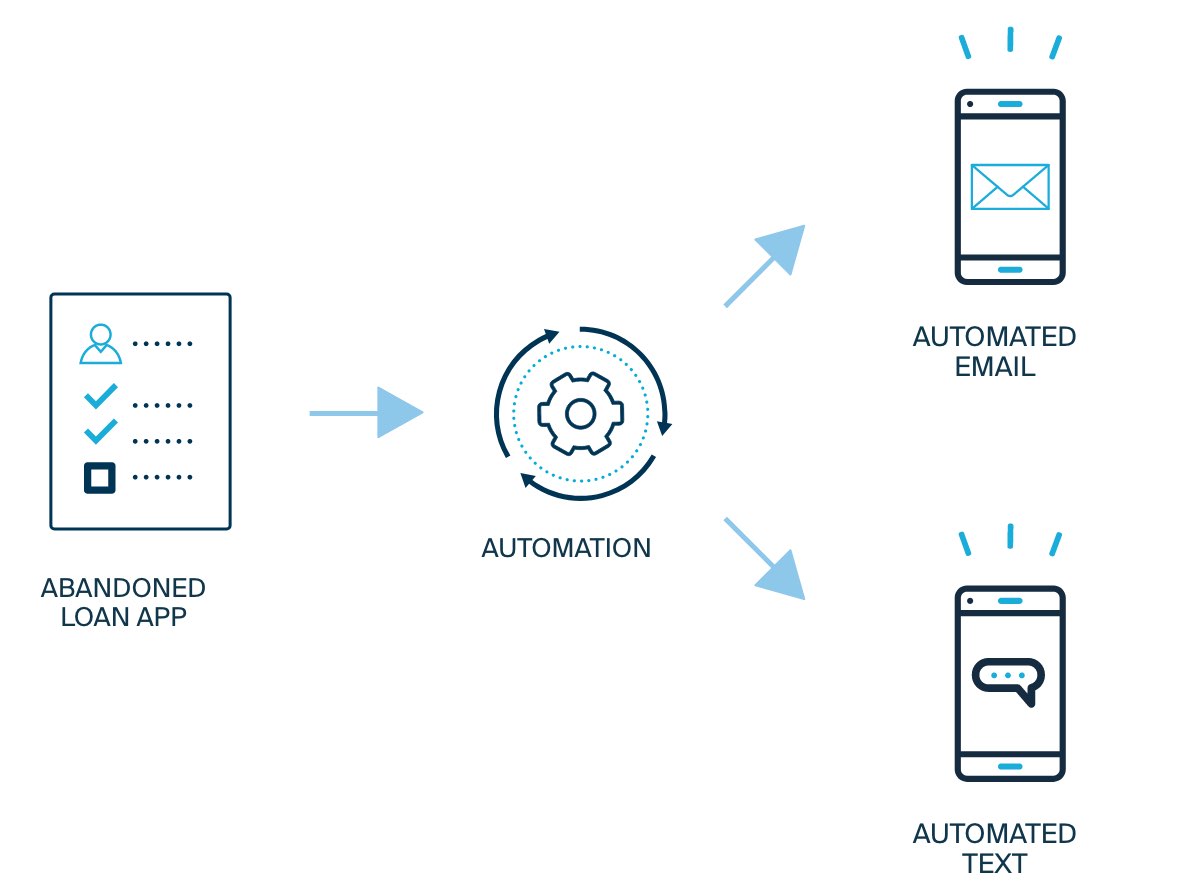

Velocify LeadManager Essentials™

Did you know manual processes can add eight or more days to the loan lifecycle? Drive more business and close loans faster with an automated multi-channel marketing and communications solution for distributed retail loan officers the enables them to drive new leads, follow-up on abandoned applications and missing documents, provide milestone updates, and nurture customers with less effort. No LO login required!

Learn more

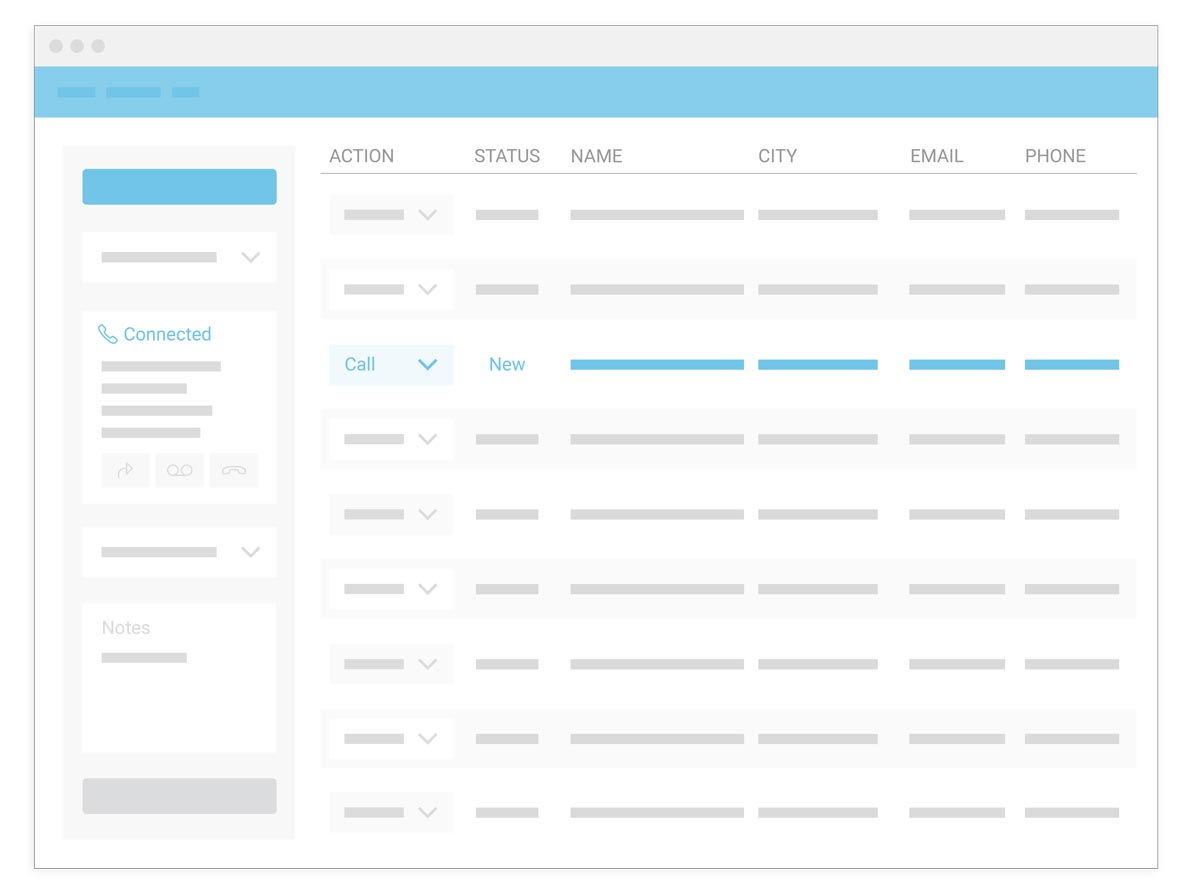

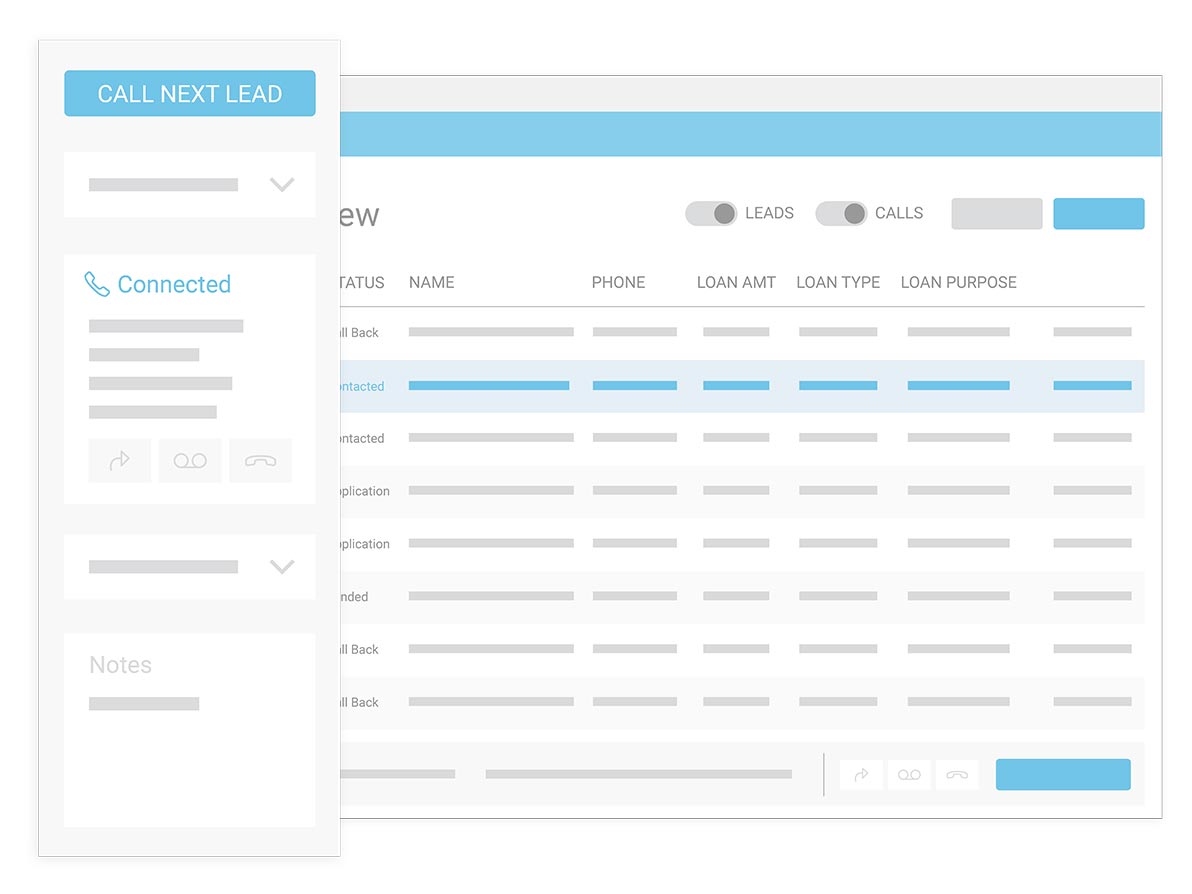

Velocify Dial-IQ®

The most reliable and functionally-rich sales dialer built for the mortgage industry. It not only enables more calls to happen, it ensures your loan officers make calls that drive conversations to actionable next steps. More productive calls, faster closing rates, and real-time reporting insights make Dial-IQ a must-have tool for your team.

Learn more

The ultimate borrower communications strategy for mortgage lenders

What's the best way to let prospects know you want their business, without those messages morphing from persistence to irritation? Give your team the tools to optimize borrower engagement and maximize productivity.

Download eBook

Take your business to the next level with ICE Mortgage Technology® Professional Services

We offer customizable implementation packages, advisory consulting, custom solutions development, and project management. Our Professional Services representatives are ready to help you optimize your system and improve operational efficiencies so you can get the most out of your investment.

See how we ensure a smooth and efficient rollout